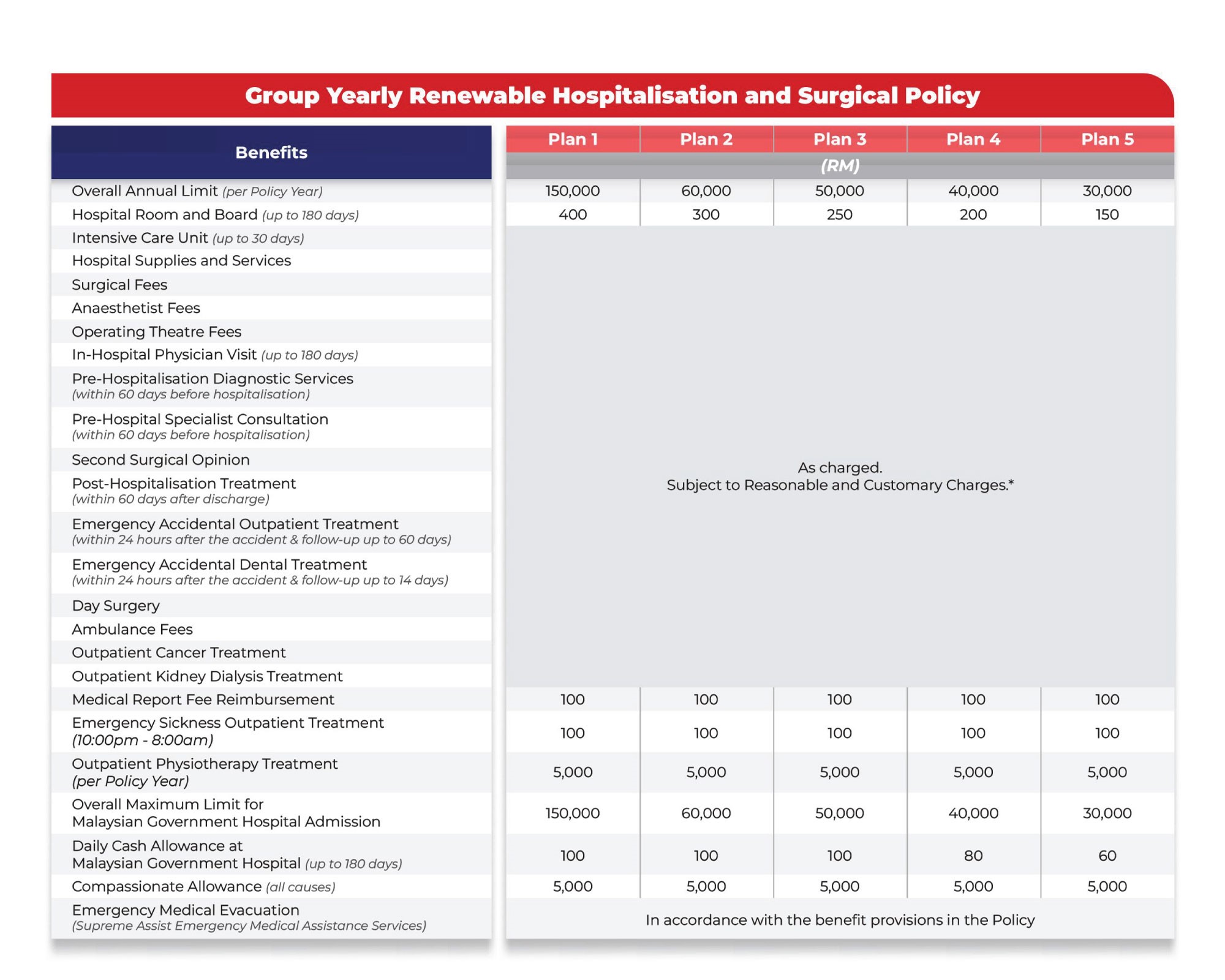

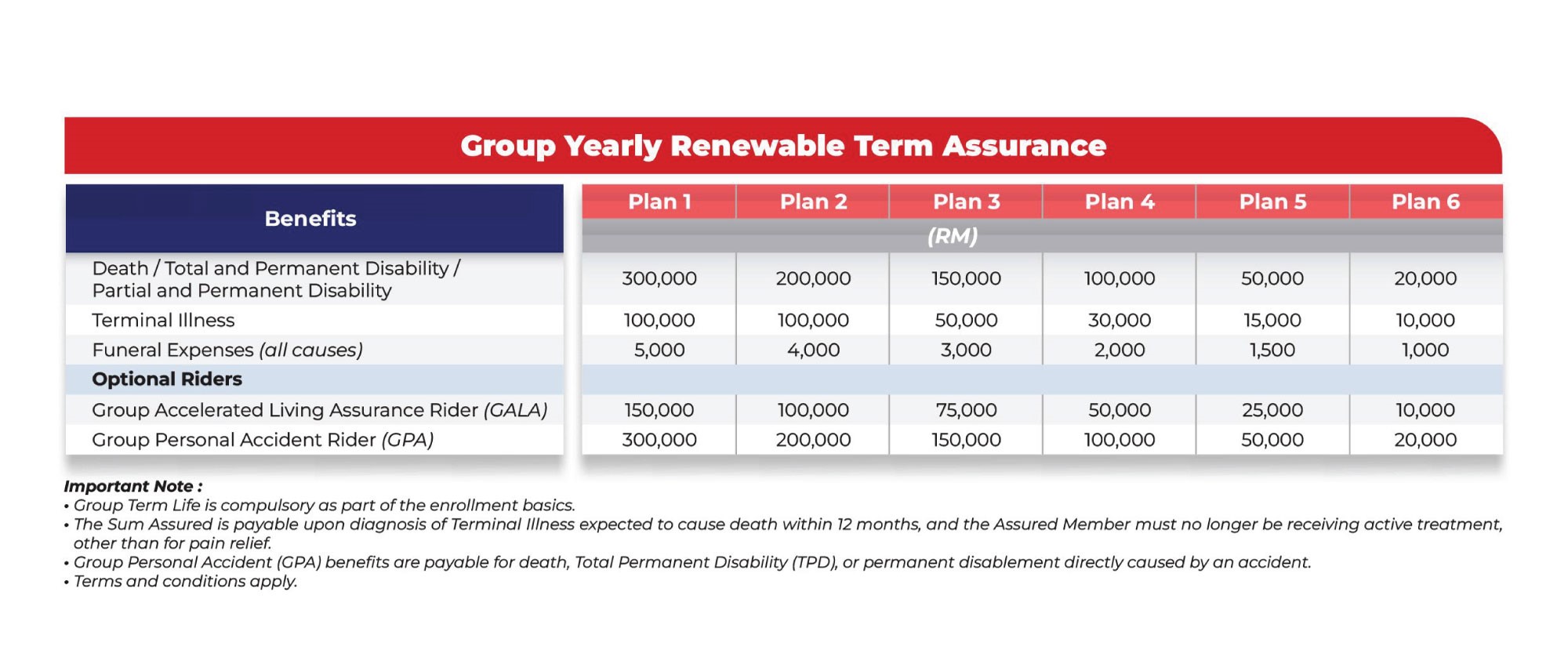

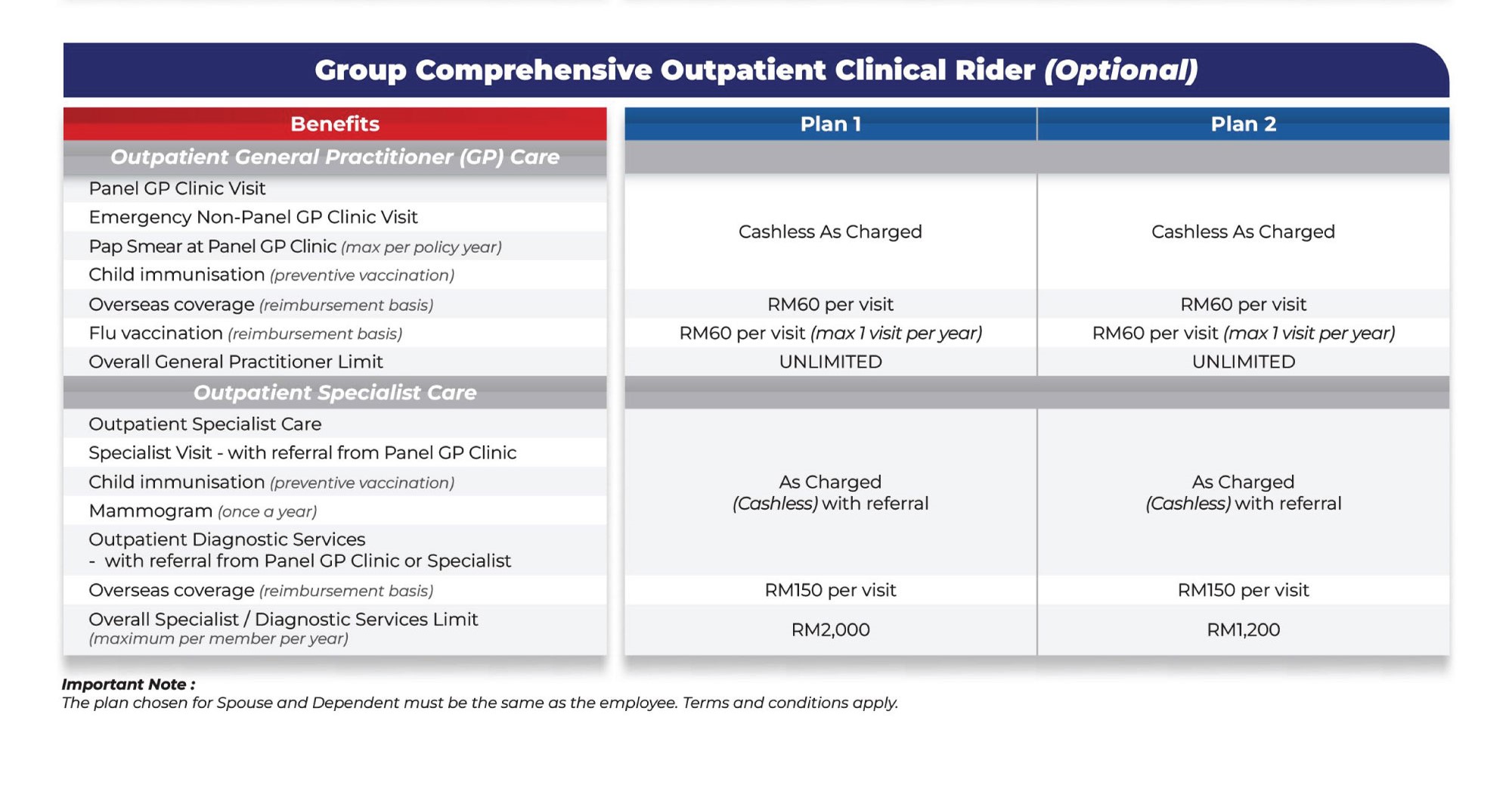

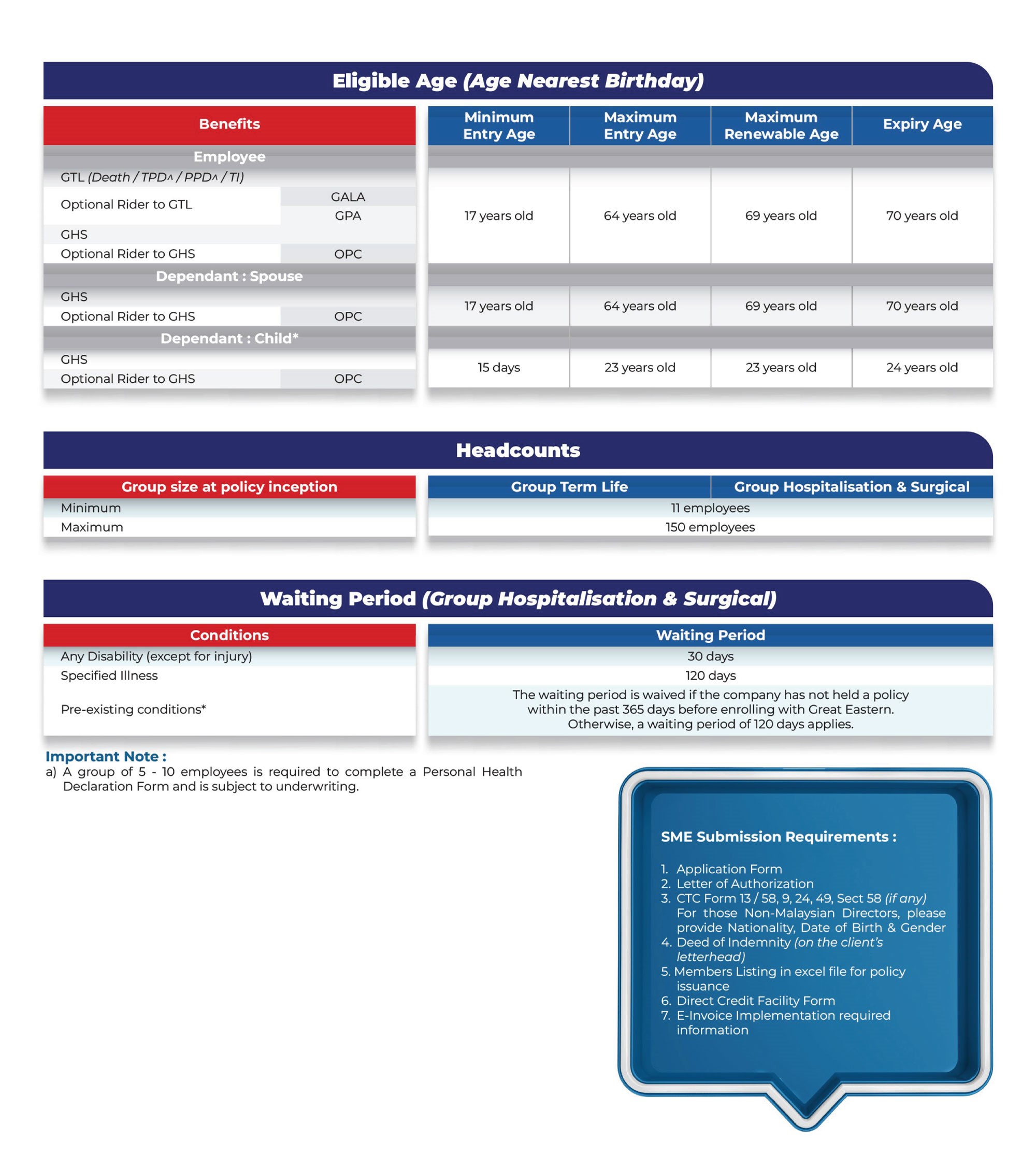

What's Included in Your Plan

Group Employee Benefits

for a Stronger Workforce

Supporting your employees with healthcare,

protection, and financial security.

More Features to Explore

Explore More

Hospital Admission Flow

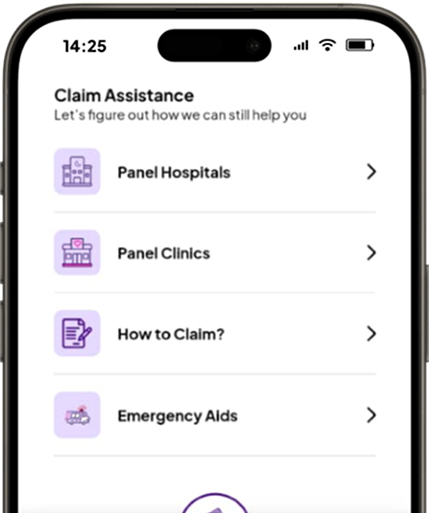

Submit your e-claim easily without worries!

Hassle-Free Claims

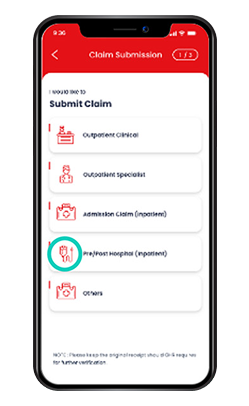

Select 'Pre/Post Hospital (Inpatient)'

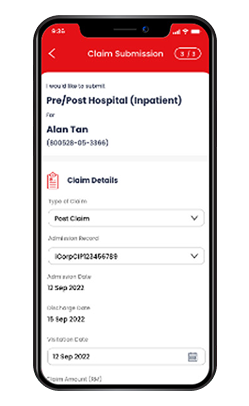

Select policy and fill in claim info

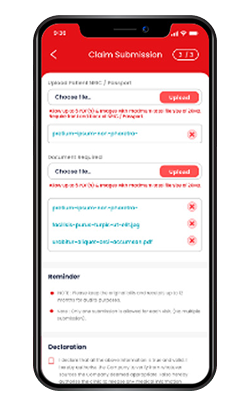

Upload claims photo & submit

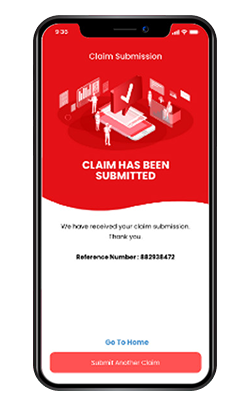

Claim submitted

Frequently Asked Questions (FAQs)

Everything You Need to Know

Important Documents

Disclaimer: MetaFin is a neutral digital platform, serving solely as a facilitator and marketplace and not a product provider. MetaFin facilitates listings independently offered by licensed corporate insurance and takaful agencies, and other service providers directly to end users. MetaFin does not endorse, or manage any insurance or takaful products. Each corporate agency is fully responsible for its own product content, compliance, and transactions conducted through the MetaFin platform. Participating agencies must comply with Financial Services Act 2013 (FSA) and/or the Islamic Financial Services Act 2013 (IFSA) by Bank Negara Malaysia (BNM).

Get to Know More About Employee Benefits for SMEs

Fill in your info — our Benefits Partner will reach out shortly!