What's Included in Your Plan

Group Employee Benefits

for a Stronger Workforce

Supporting your employees with healthcare,

protection, and financial security.

All full time and actively at work employee (between the age of 16 to 64 years of age), in occupational classes 1 to 4 are eligible for Medical and Group Term Life/Takaful coverage.

An employee's spouse (between the age of 16 to 64 years of age) and unmarried children (over fourteen (14) days but below nineteen (19) years of age or twenty three (23) years of age if still studying full time and not gainfully employed) are eligible for Medical (basic and optional) coverage only.

| Class | Occupations |

|---|---|

| 1 | Professional Administrative Secretarial, Clerical and Managerial classes not engaged in manual work, lawyers, architects, physicians, school teacher, production operators of non-hazardous semi-conductor/textile manufacturer. |

| 2 | Shopekeepers, and Shop Assistants not using machinery and not involved in any special hazard, Salesman, Nurse, Messenger (on foot), Reporters, Photographers, Dentist, Agents, Clerk handling goods, Inspector of Commercial firms, Managers of factories, tailors, etc. |

| 3 | Veterinary Surgeons, Cooks, Waiters, Barbers, Chauffeurs (domestic), Civil Engineers, Actor and Actresses, Supervisors of factories and transportation companies, Janitors & Watchmen (unarmed), etc. |

| 4 | Bakers, Bicycle Deliveryman, Taxi Drivers, Gardeners, Nurse (insane asylum), Electrical Engineers and Electrician (handling 250 volts or below), skilled Manual Workers, Rubber Tappers, Farmers, Machinist (non-hazardous industries only), Labourers, etc. |

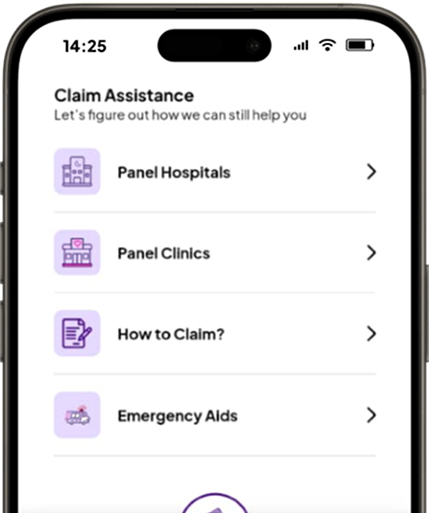

More Features to Explore

Explore More

Hospital Admission Flow

Frequently Asked Questions (FAQs)

Everything You Need to Know

Important Documents

Disclaimer: MetaFin is a neutral digital platform, serving solely as a facilitator and marketplace and not a product provider. MetaFin facilitates listings independently offered by licensed corporate insurance and takaful agencies, and other service providers directly to end users. MetaFin does not endorse, or manage any insurance or takaful products. Each corporate agency is fully responsible for its own product content, compliance, and transactions conducted through the MetaFin platform. Participating agencies must comply with Financial Services Act 2013 (FSA) and/or the Islamic Financial Services Act 2013 (IFSA) by Bank Negara Malaysia (BNM).

Get to Know More About Employee Benefits for SMEs

Fill in your info — our Benefits Partner will reach out shortly!